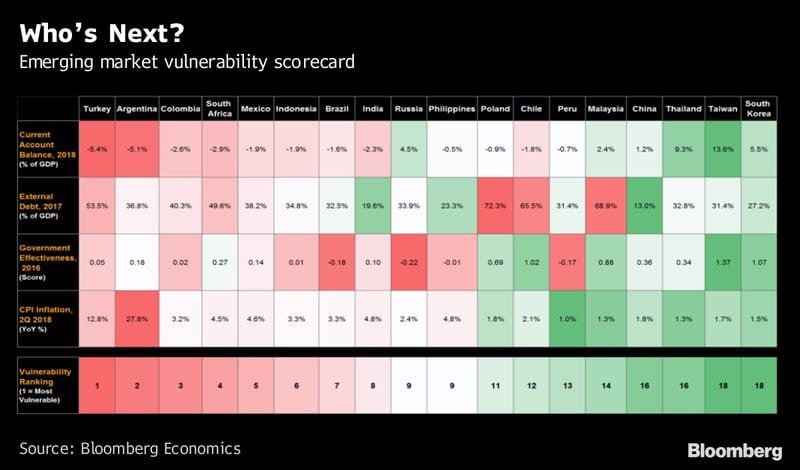

“Although 2018 seems to be the most impressive of the last 6 years in terms of economic performance, with an expected 2.6% growth and a 3.0% inflation, Colombia is still the most vulnerable emerging market after Argentina and Turkey.”

The peso has reached its highest price against US dollar in 2018 this Monday, when it was trading at about 3004 Pesos per Dollar on the Colombia Stock Exchange, 45 pesos more than last Friday’s market price.

A 100 pesos devaluation rally started last Thursday and was accelerated with the Lira black Friday, when the Turkish currency got a 14% devaluation affecting all the other emerging economies. The surpassing of the 3000 pesos ceiling, contradicts the Banco de la República experts who expected to reach the 2950 by the end of august.

The Turkish Lira crisis started at the beginning of the year with diplomatic tensions between Ankara and Washington and was boosted by the tariffs imposed by the Trump administration over steel and aluminum. The currency has lost 50% of its value this year compared against the US dollar and the euro.

Fear spread between emerging markets investors, who immediately rushed to the exit, looking for safe-havens (Swiss francs, dollar and yen) for their assets. To put in perspective how one emerging economy could affect the others, this Monday the lira devaluated 7%, triggering devaluation in other emerging economies currencies like Argentinian peso (2.4%), South African rand (2.3%) and Colombian peso (2.0%).

Why are the emerging economies having an economic turndown?

Turkey is not the only one having big problems. The Argentinian peso, for instance, has lost 63% of its value this year and a 32% inflation is expected this year, which is especially unfortunate, as Argentina already has the highest interest rates in the world. The MSCI Emerging Markets Index, which measures the performance of 24 countries, has dropped 19% from its peak in January.

The main reasons for this negative performance are: first, investors´ fear regarding the trade war between the US, China and Russia, and second, the increase of the interest rates in the US which has caused a capital outflow from the emerging markets to the North American market, worsened by the credit bubble of countries like Argentina, South Africa and Turkey, which have borrowed nearly 260 billion dollars since 2010 according to the IMF.

What about Colombia?

Although 2018 seems to be the most impressive of the last 6 years in terms of economic performance, with an expected 2.6% growth and a 3.0% inflation, Colombia is still the most vulnerable emerging market after Argentina and Turkey. This can be explain by the high external debt (40% of GDP), deficit in the account balance, and low governmental effectiveness (the lowest of the top 5 most-vulnerable emerging countries) according to Bloomberg.

It is clear that Colombia doesn’t have the same vulture funds issues as Argentina, the diplomatic crisis of Turkey or the high inflation rates of both, but it does share two distinct features with the two other countries: Colombia is highly dependent on dollar-borrowing and has an increasing deficit in the balance of trade. Since March, Direct Foreign Investment has decreased from 913 to 546 million dollars, while 299 million dollars flew out of the country in Portfolio Investment following the high interest rates of the US. Still, analysts expect the Colombian peso to stay under the 3200 rate until the end of the year and a potential crisis seems far away as long as the new president Iván Duque achieves his goals regarding public deficit.